FX Industry Trends for 2023 and Beyond

December 1, 2022

Why IB/Affiliate Management Platforms are More Important Than You Think

December 26, 2022

What comes to mind when you think of simplified trading? Some of you may think of something like binary options. Some of you may be imagining super simple platforms that look more like online gambling games than real markets. You may not have even considered the idea of simplified trading before because you think that real trading is for “serious” people and so to simplify it is to make a mockery of it.

When we at Panda talk about simplified trading, we don’t mean any of the above. What we mean is best expressed by our new Simplex trading platform. A CFD platform that can compete with anything out there in terms of looks, usability, and features. A platform that’s professional, intuitive to get the hang of, and can probably outmatch your existing one in terms of charting options, indicators, drawing tools, and more.

What about simplification? Well, this comes down to a novel approach we’ve taken that keeps all the bells and whistles of traditional trading platforms, while simplifying the most important areas of order entry and risk management. These are the areas that typically give new traders the hardest time.

At Panda, we’re always looking for new ways to serve our growing client base of brokers. Having access to so many of them can be hugely informative, because you hear all about the issues they’re trying to solve, and you get a sense of common themes developing across the industry. One of the most common of these is the steep learning curve of CFD trading. It’s easy enough to get the sign-ups in, but once registered, a significant percentage of these customers get stuck between signing-up, and starting to trade.

Offering demo platforms is, of course, helpful. It allows some learning to take place in a risk-free environment. But even so, there’s still a leap of understanding that has to take place before a beginner to this world grasps the basics of CFD trading.

In some ways, even crypto exchanges have it easier than CFD brokers. You want to buy a crypto coin, it’s worth X, you have Y in your account, you press the “buy” button and the trade goes through as a market order. Now you have Y minus X, plus the coin you were trying to buy in the first place. Simple enough.

But CFD trading introduces complexities that most beginners aren’t accustomed to. You have margin to deal with, and leverage. You have the ability to “sell” something you don’t own, and the ability to “buy” a currency pair such as GBPUSD when your account is held in euros. You have stop-loss and take profit levels. You have lot sizes.

The idea behind Simplex, is that you can keep all the charting features that make trading interesting to both beginners and experienced traders. These features make research and trend identification possible, and that’s a huge part of trading. Also, when you strip these things out of a simplified platform, you’re not only making the customer feel like they’re not trading “for real,” you also remove the main way that many retail traders get their ideas, develop their strategies, and grow their confidence.

Give someone who’s even slightly interested in trading access to a powerful charting platform with a full history of an asset that they care about, and in no time, they’ll have ideas and theories about where that asset is heading next. Charts are addictive, they’re interesting and fun, these are not what needs to be simplified.

What needs to be simplified is position entry and risk management. Particularly when trading CFDs. A typical CFD platform requires the user to do all of the following before entering a trade. Select a symbol, choose between instant and market execution, enter the volume of in lots, enter stop-loss and take-profit levels (optional), enter an acceptable deviation range in pips, press buy or sell. At no point in any of the above does the beginner gain an easy understanding of just how much they’re investing in the position. Beginners think in currency terms, even some experienced traders still do.

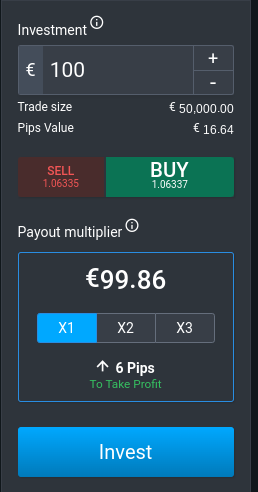

Simplex does away with this complex order entry process in the following ways. First and foremost, the platform prompts the trader to define an investment amount. This is how much capital the trader is willing to put at risk on the particular trade. It’s the first thing a beginner thinks of, so we made it the first part of making a new trade. It also doubles up as an automatic stop-loss level because it defines at what point the trade will be automatically closed if the trade goes the other way. Unlike in the example above, once this amount is selected, the trader only ever stands to lose this specific amount if things go wrong.

Now, depending on the leverage ratio of the account in question, the trade size and the value of each pip move is automatically calculated and presented to the trader before they ever invest a single dollar. With the investment amount selected, the trader can also choose whether to buy or sell the underlying asset (go long or short), and as for when the trade is to be closed at a profit, we’ve come up with a clever simplified way to do this too.

Stop-loss and take-profit levels are handled in an equally innovative and easy-to-understand manner. Below the investment amount and buy/sell buttons there’s a payout multiplier box with the options of X1, X2, or X3. X1 sets the stop-loss 6 pips above the current price, X2 sets it 12 pips above the current price, and X3 sets it 18 pips above the current price. The stop-loss remains the same in all three scenarios because it’s determined by the investment amount and not the payout multiplier.

Once the trader has selected their investment amount, the direction of the trade (buy/sell), and the payout multiplier, all that’s left for them to do is to press the investment button and voilà, they have just made their first trade, in a radically simplified way, on a platform that doesn’t look like a toy.

In all other respects, Simplex boasts a full feature set, with an attractive and easy to use charting interface, complete with a truly impressive array of technical indicators, studies, and drawing tools. It’s also optimized for any device, so it’s just as easy to use on mobile or tablet with a touch screen as it is on a laptop with a trackpad, or a desktop with a mouse.

Game-changer gets thrown around a lot in our industry, but we believe Simplex truly is a game-changing product for brokers wanting to give their beginners a helpful first step to becoming a fully-fledged trader.

To find out more about Simplex, or to schedule a demo, please get in touch with our team.

For free consultation

Request a Call